How To Get Copy Of Chapter 13 Discharge Papers Things To Know Before You Get This

More About How To Obtain Bankruptcy Discharge Letter

Table of ContentsSome Known Incorrect Statements About How To Get Copy Of Chapter 13 Discharge Papers Not known Incorrect Statements About Bankruptcy Discharge Paperwork See This Report on How Do I Get A Copy Of Bankruptcy Discharge PapersFascination About Obtaining Copy Of Bankruptcy Discharge PapersIndicators on How Do You Get A Copy Of Your Bankruptcy Discharge Papers You Need To KnowThe Facts About Bankruptcy Discharge Paperwork Uncovered

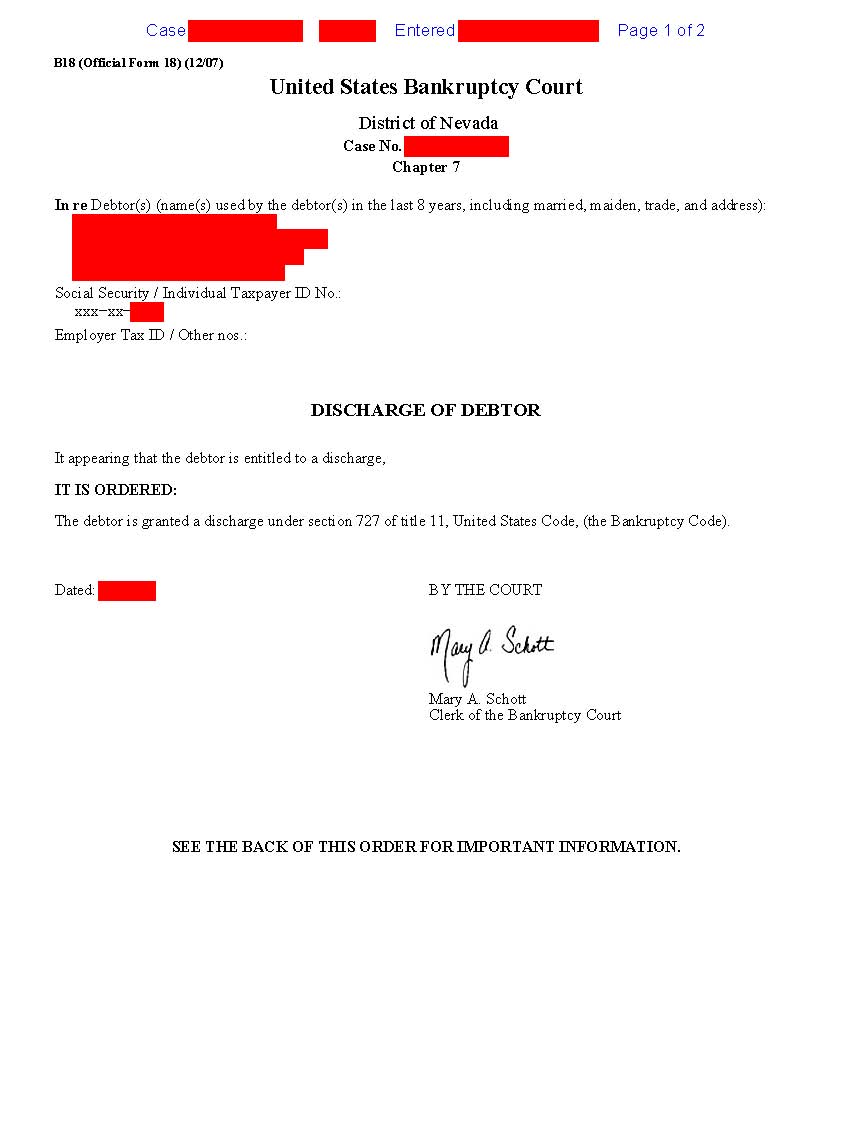

Your bankruptcy discharge order offers you the verification that your case is now shut and all of the financial debts included are non-enforceable. Consequently, lenders detailed in the bankruptcy request can no more contact you about your debts or submit an action versus you for collection. You must store all of these insolvency records because of your requirements to provide them if you apply for an undocumented finance later.You need to maintain your bankruptcy discharge order in a secure place because life takes place, as well as a bankruptcy discharge order and also various other insolvency records can obtain lost. A Debtor must always maintain a duplicate of their personal bankruptcy court records.

There are numerous methods to get a copy of your bankruptcy discharge order as well as associated documentation. The most convenient method would be to connect to the lawyer or law company that filed your personal bankruptcy petition. You can call the clerk of courts for the insolvency court where you filed your situation.

The 30-Second Trick For How To Get Copy Of Bankruptcy Discharge Papers

Many insolvency legal representatives bill a nominal charge for these records. All bankruptcy lawyers have access to PACER and can print any type of bankruptcy request as well as discharge. Nonetheless there is a cost they are charged for use of this service. If you're bothered with exactly how much it'll cost to get your lawyer to fetch your records, inquire prior to you employ a person! There's a great chance that they will execute this service totally free.

If it is greater than you are eager to pay, explore your various other alternatives for obtaining a duplicate of the bankruptcy discharge order. The most efficient means to ask for a duplicate of your bankruptcy papers is in the courthouse, where your situation was submitted. Numerous court houses supply cost-free incurable access to the public.

Indicators on Copy Of Bankruptcy Discharge You Need To Know

In addition, copies of a personal bankruptcy instance file are occasionally billed per page. You can order insolvency documents by calling the clerk's office.

If you spend much less than $15 within three months, your account is cost-free to utilize. For added information, check out the PACER site () for directions on just how to register for PACER and also the expenses of downloading court files. On April 1, 2004, this Court started making use of digital declaring. For that reason, situations submitted prior to that day might be discovered at the National Archives Federal Records Center (FRC).

Things about How Do You Get A Copy Of Your Bankruptcy Discharge Papers

The National Archives does not keep all insolvency instances. When you send an ask for records from the FRC, you will certainly be educated if the case is still available. The FRC uses the type here are the findings NAFT 90 to ask for personal bankruptcy situation papers. The type needs a set of numbers to identify the area of an instance.

This details should be acquired from the Bankruptcy Staff's Office, where the case was filed to be tracked. An estimation of when the insolvency application was submitted - https://zipzapt.com/author/b4nkrvptcydcp/.

These are usually costly solutions. On top of that, these solutions are frequently bad, or you might never have your paper. Attempt to prevent such services. It is better initial to attempt speaking with the personal bankruptcy legal representative that submitted your instance. If there are not offered, set up a PACER account online or connect to the Court.

Indicators on How To Obtain Bankruptcy Discharge Letter You Need To Know

As Michigan personal bankruptcy lawyers we have access to PACER and can assist you. We can get personal bankruptcy records for any kind of person that filed in the State of Michigan.

If you are thinking of filing insolvency we provide a totally free assessment to review your instance. Call today.

The Clerk's Workplace will certainly send by mail a duplicate of the discharge to the borrower, the instance trustee, and also all financial institutions. The discharge will be sent by mail to the addresses revealed in the debtor's checklist of creditors or in the schedules, whichever is filed later on. - Duplicates of a discharge may be acquired making use of the very same process utilized to obtain copies of any kind of other record filed in a bankruptcy case.

How To Obtain Bankruptcy Discharge Letter for Beginners

The Discharge/ Dismissal Records are the Official documents authorized by the court to supply evidence the personal bankruptcy is total. Routines D, E, F (Creditors detailed in your personal bankruptcy). This package additionally includes your Discharge/ Dismissal Records. This site is to aid in buying Authorities Bankruptcy Court Records, for individual bankruptcies.

Records Clerk, by calling (800) 988-2448, Monday - Friday 9AM - 5PM (omitting lawful holidays). All Personal Bankruptcy Documents got on the site, is electronically sent out using email, generally within a hr, unless otherwise requested to be sent U.S.P.S. Duplicates are legal documentation as well as assured compliant with all loan provider, creditor, as well as debt reporting firm demands.